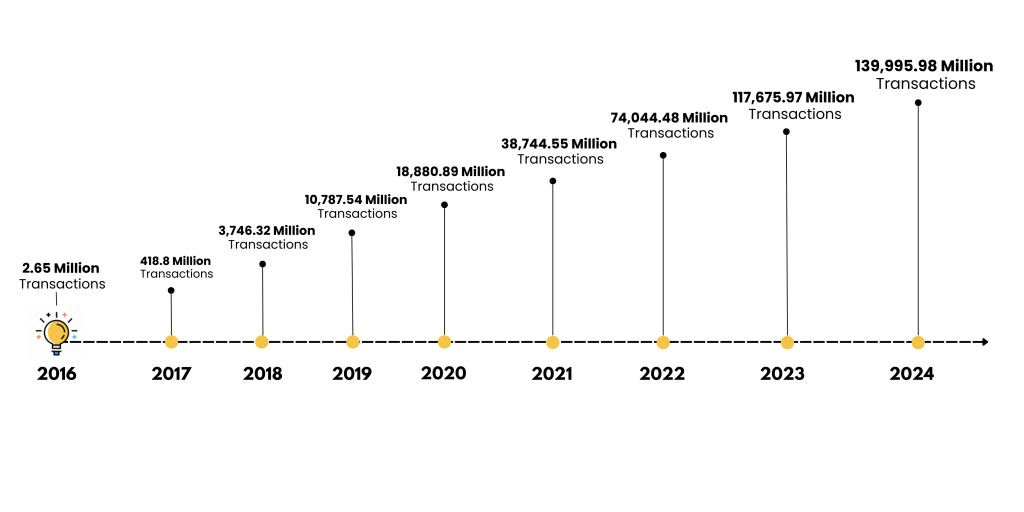

The Unified Payments Interface (UPI), launched by the National Payments Corporation of India (NPCI) in 2016, has revolutionized the digital payment landscape in India. Designed to facilitate seamless, instant fund transfers between bank accounts via mobile devices, UPI has become a cornerstone of India’s push towards a cashless economy. Understanding UPI’s impact, growth metrics, and its standing compared to global payment systems is crucial for informed policy-making and fostering further innovation in the financial sector.

UPI’s Exponential Growth: A Data-Driven Perspective

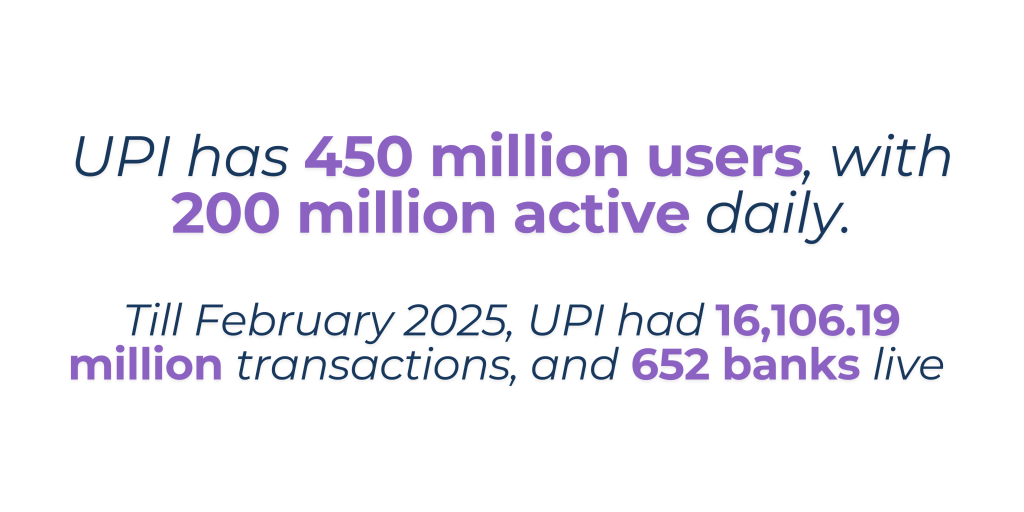

In January 2025, UPI transactions crossed 16.99 billion, with the total value exceeding ₹23.48 lakh crore—setting a new record for the highest monthly transactions. The Finance Ministry highlighted this as part of the strong growth seen in India’s digital payments sector during 2023-24. In 2023-24, the total number of transactions crossed 131 billion, with the overall transaction value exceeding ₹200 lakh crore.

Key Features:

Unlike traditional banking systems that require cumbersome account details for transactions, UPI simplifies the process by enabling instant transfers through a Virtual Payment Address (VPA), mobile number, or QR code. Here are some key features that make UPI stand out:

- Interoperability: UPI allows users to link multiple bank accounts to a single application, eliminating the need for multiple banking apps.

- Real-Time Transactions: Payments are processed instantly, 24/7, eliminating delays associated with traditional banking methods.

- Zero or Minimal Transaction Fees: Unlike credit or debit cards that charge transaction fees, most UPI transactions remain free or attract minimal charges, making it a cost-effective solution.

- Multiple Use Cases: From peer-to-peer (P2P) transfers to merchant payments, bill payments, and government disbursements, UPI caters to diverse needs.

- Merchant and Global Adoption: Over 50 million merchants now accept UPI payments, and its international expansion continues in countries like Singapore, UAE, and France.

State-Specific Adoption: A Closer Look

While national figures highlight UPI’s widespread acceptance, state-specific data offers insights into regional adoption patterns:

- Maharashtra: Leading in UPI transactions, with metropolitan areas like Mumbai and Pune driving usage due to a robust digital infrastructure and tech-savvy population.

- Karnataka: Cities such as Bengaluru have significantly contributed to high transaction volumes, reflecting the state’s strong IT sector presence.

- Uttar Pradesh: Notably, both urban and rural areas have embraced UPI, showcasing its reach across diverse demographics.

- Bihar and Odisha: These states have seen rapid growth in UPI adoption, attributed to increased smartphone penetration and digital literacy initiatives.

UPI in the Global Context: Comparative Analysis

Compared to other payment systems, UPI stands out due to its low cost, instant settlements, and government-backed infrastructure. UPI’s success has positioned India as a leader in real-time payment systems.

- Brazil’s Pix: Launched by the Central Bank of Brazil in 2020, Pix facilitates instant payments and transfers 24/7. By 2023, Pix accounted for 15% of global real-time transactions, making it the second-largest real-time payment system after UPI.

- Singapore’s PayNow: This system allows users to send and receive funds instantly using mobile numbers or National Registration Identity Card (NRIC) numbers. In a significant development, India linked UPI with PayNow in February 2023, facilitating seamless cross-border transactions between the two countries.

- United States’ FedNow: Scheduled for launch by the Federal Reserve, FedNow aims to provide instant payment services across the U.S. However, the U.S. market’s heavy reliance on credit cards and associated rewards programs presents challenges to the widespread adoption of such real-time payment systems.

- European Union’s SEPA Instant Credit Transfer: This system enables euro transactions across SEPA countries within seconds, promoting faster payments within the EU.

Challenges and Considerations

Despite its successes, UPI faces challenges that require attention:

- Security Concerns: The surge in digital transactions has led to increased attempts at fraud, necessitating continuous enhancements in security protocols and user awareness campaigns.

- Infrastructure Strain: The massive volume of transactions demands robust infrastructure to ensure system reliability and prevent downtimes.

- Global Integration: As UPI seeks to expand internationally, aligning with diverse regulatory frameworks and achieving interoperability with other countries’ payment systems remain complex tasks.

Conclusion

UPI has fundamentally transformed India’s digital payments ecosystem, fostering economic growth, financial inclusion, and convenience. With its continuous evolution and global aspirations, UPI is not just an Indian success story but a model for the world. As India advances towards a cashless economy, UPI will remain at the forefront, shaping the future of digital payments with its innovative and inclusive approach.