India’s shift to digital public procurement — led by the Government e-Marketplace (GeM) and national eProcurement systems — is reshaping how the state buys goods and services. Faster, more transparent, inclusive and measurable procurement is already delivering massive economic volumes and bringing millions of vendors into the formal supply chain. Here’s a crisp, numbers-first explainer for HODO.AI readers.

What is eProcurement and GeM?

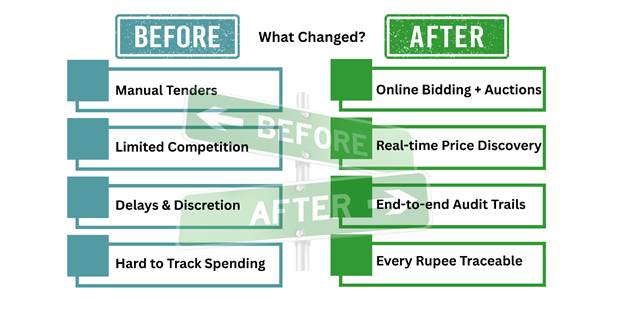

eProcurement refers to the set of digital systems governments use to run competitive procurement (tenders, bids, orders, contract management) online rather than on paper. In India this includes the Central Public Procurement Portal / eProcurement platforms used by ministries and public-sector units.

GeM (Government e-Marketplace) is a complementary, transaction-first marketplace launched in 2016 to let government buyers procure standardized products and services through an easy online storefront, reverse auctions, cart-based or direct procurement modes — with built-in compliance, price discovery and performance metrics. Together these digital platforms form the backbone of India’s modern public procurement architecture.

The headline numbers

- FY 2024–25 GMV on GeM: ~₹5.4 lakh crore in transactions (Gross Merchandise Value) during FY25 — a dramatic rise from ~₹1.06 lakh crore in FY21 and ₹2.01 lakh crore in FY23.

- Registered sellers & service-providers: Over 22 lakh registered sellers/service providers on GeM (early 2025 figures).

- Buyer base: GeM serves ~1.6 lakh+ government buyer entities (central ministries, states, PSUs, local bodies) and counting.

- Order volumes: Millions of orders processed — GeM and related portals have processed tens of millions of orders since launch (orders and transactions in the multiple-million bracket).

These headline figures show an extremely rapid scale-up: what started as a small experiment has become one of the world’s largest government procurement marketplaces by volume.

Why the numbers matter — the concrete impacts

a) Transparency & price discovery

Digitization exposes historical pricing, supplier identities and competitive bids — reducing information asymmetry and leakages. Public order trails and standard product catalogs make it harder to favor opaque suppliers, and easier for auditors, citizens and oversight bodies to spot anomalies. (Supported by the design and adoption of GeM and eProcurement portals.)

b) Faster procurement cycles & administrative efficiency

Automated workflows (RFQs, e-bidding, reverse auctions, e-contracts) dramatically shorten cycle times compared with manual tendering, enabling agencies to deliver services and projects faster — which scales meaningfully when the platform is handling ₹lakh-crore level annual spend.

c) Inclusion of MSMEs and sellers across India

With over 22 lakh sellers on GeM — including micro, small and medium enterprises (MSEs) — smaller suppliers get access to large government demand without needing entrenched intermediaries. This helps deepen local supply chains, create business for underserved regions and increases competition (often driving down prices).

d) Market signal & policy leverage

Large, standardized procurement datasets create a unique signal for policymakers: what the government buys, where demand clusters, and where capacity gaps exist. That data can guide industrial policy, local manufacturing pushes, or targeted seller-development programs. GeM’s rapid GMV growth turned procurement into a measurable lever for procurement-led growth.

The growth story — how fast did this happen?

GeM’s GMV growth is striking: from a modest pilot scale in 2016 to ₹5+ lakh crore annual transactions by FY25 — a multi-year CAGR measured in dozens of percentage points depending on the reference period. Services have been a major growth engine (services accounted for a large share of recent FY25 growth), while product procurements also rose sharply year-on-year. The platform’s rapid onboarding of buyers and sellers has been central to this leap.

Real-world examples of impact (by use-case)

- State adoption: Several states have plugged their procurement rules and state-level buying into GeM, leading to entire state departments moving purchases to the platform and unlocking aggregated buying power. (Example: high state buyer participation and top-buyer reporting.)

- Hiring & services market: GeM’s services vertical expanded quickly and even facilitated hiring/service contracts at scale, creating downstream economic activity (contractors, consultants, service providers).

Challenges that remain

- Category fit & customization: Not every complex, bespoke procurement is suited to a marketplace model — large infrastructure packages, complex consultancies and non-standard works still need hybrid tendering approaches.

- Capacity & onboarding: Smaller sellers need help meeting compliance, cataloging and digital payment norms; otherwise, good vendors won’t list or will do so ineffectively.

- Governance & misuse risks: Digital logs increase auditability, but new types of operational risks (misuse of exemptions, cart-based bypassing in sensitive sectors, or ad-hoc state rules) must be managed through policy guardrails. (Recent state directives on healthcare procurements underline the need for clear operating rules.)

What’s next — evolution & tech frontiers

- AI and analytics on procurement data: Predictive demand, supplier risk scoring, category optimization and dynamic vendor discovery will become standard — turning procurement from a transaction engine into a foresight engine.

- Interoperability across state systems: Deeper plug-and-play integrations between local government ERP, finance, inventory and GeM/eProcurement portals will reduce duplicate data entry and speed approvals.

- Supplier capability programs: Focused onboarding, finance facilitation and quality certification for MSMEs will be crucial to turn registered sellers into active, competitive suppliers.

Quick takeaways for policymakers, buyers & platform builders

- For policymakers: Digital procurement is no longer a nice-to-have — it’s a high-impact lever for transparency, fiscal efficiency and MSME inclusion. Continued investment in governance rules and capacity building will pay outsized dividends.

- For government buyers: Standardize categories, leverage analytics for bulk buying, and lock in eProcurement flows to reduce cycle times and audit friction.

- For tech teams & startups: Large, structured procurement datasets are a fertile ground for analytics, supplier finance, compliance automation and specialized marketplace services.